Introduction

Although debtism is still called and confused with neoliberalism, this is only partially true, and these aspects of neoliberalism were considered in the previous creative article. In fact, debtism is a hybrid composed of mixed and mutually compatible ideas of neoliberalism, state regulation, and interventionism in global markets in conjunction with the irresponsible social market behavior of the majority of (key-) actors, which is much closer to the way of running the economy and business in conditions of macro-economic and micro-economic settings of the social market economy, but at the national level. In other words, despite the application of state regulation and interventionism through the reshaping and adaptation of monetary, financial, and fiscal measures to this debt mode of global economic management, all this has little in common with Roosevelt's New and National Deal, as his response to the Great Depression of the 1930s. In short, the main feature of this mode of application of state interventionism is its global reach and scope, whereby the governments of countries affected by this global crisis raced to take on more debt from these crisis-affected actors, and not just by intervening with available taxpayers' money.

The social market economy in Western Europe culminated with the creation of social welfare states, particularly in the countries which bordered on the communistic countries of the Warsaw Pact. This social welfare was characterized by the implementation of social policy in the field of education, health care, social housing, working conditions, rights and participation of workers in the management of companies and the like as countermeasures to related communistic concepts as well as for purpose of gaining general public support of their population to counter socialist movements inside of their countries. In Anglo-Saxon countries, this social role is mainly played with various private organizations (charities).

On the other hand, in spite of the failure of classical liberalism [free market and a minimal state] in the 1930s as a result of the Great Depression, neoliberalism resurrected out of the ashes of the Great economic oil crises of the 1970s. Although, the downfall of colonialism also contributed to the creation of a broader framework for the emergence of neoliberalism, the intervention of the intergovernmental association of the biggest oil producers (OPEC) on the INTERNATIONAL markets to regulate the price of such an important commodity as the oil is, opened the eyes of some western proponents of the state interventions and regulation too, which until then was mainly bounded at the NATIONAL and international level of the western political, financial, and economic alliance. In other words, this allowed them to notice shortcomings and limits of their approach to dealing with the issues and aspects of this wider understanding of international markets.

neoliberalism and neo-colonianism

Since the hidden rulers of this emerging economic and financial order are also masters to perceive new business opportunities for gaining access to cheaper resources at this international level, that is, to maximize further profit and efficiency of their way of doing business (corporate welfare), particularly after the fall of colonialism, they reversed and reshaped this OPEC idea applying it at a much wider international scale in the form of free movement for capital, goods, and services. In short, for the access, allocation, and exchange of scarce resources more efficiently on this international scale by means of demand and supply, these international markets must be free to trade and investment on an ongoing basis. This master-plan was regulated during this stage of neoliberalism development by General Agreement on Tariffs and Trade (GATT) as well as facilitated by UNCTAD.

In other words, neoliberalism recognized that the state must be active and proactive in the organization of an international market economy to keep the market free and under the control. Using their economic and financial power, they managed to get the less-developed countries to participate in this created international economy under terms that are basically unfavorable to these poor countries. For example, highly subsidized agricultural products within their national borders additionally undermined the already weak economies of these underdeveloped countries. In addition to this, by the passage of time, subsidizing industrial products and goods was sanctioned and later forbidden, not to mention these poor countries did not even have the funds for that purpose. Apart from this, access to the national markets of the (highly) developed countries was protected by various trade barriers. For example, internationally agreed food safety standards, quality management standards, as well as obtaining appropriate certificates proved to be a huge obstacle to their mostly agricultural and food products.

Moreover, the highly sophisticated goods and services exported from developed countries affected culture and changed the way of living of people in the underdeveloped countries. The only visible result of this way of running the international economy is a significant increase in population in these underdeveloped countries: an inexhaustible source of even cheaper labor and consumers for their goods and services, which is essential for the further growth of international trade and return on foreign direct investment. In other words, in full accordance with the neoliberal way of running the international economy, if the cost of labor cannot be lowered as well as an increase in consumption on this real wage basis within national markets because these two goals contradict each other, this is more easily feasible with the creation of free international markets.

At the same time, the period of Baby Boom after the Second World War in the (high) developed countries has been replaced by a drastic drop in birth rates and an aging population, as a result of these neoliberal ideas in action [indirect discouragement of growth of families] in spite of the increased immigration from these underdeveloped countries. In other words, in full compliance with the logic of neoliberalism, the traditional family values were continuously undermined and replaced by the creation and marketingzation of mass consumer society, especially through the encouragement of buying goods on credit, that is, before this was finally repayed: selling in this way the future of their families [indebting them and their offspring at a massive scale]. On the other hand, the population aging

- [understood also in terms of a steady decline in consumer spending compared to disproportionately increase in pressure on the public budget]

in interaction with declining birth rates and rising life-expectancy is also a huge challenge for democracy, not only in social, financial, and economic terms but in political terms as well because every adult citizen has the right to vote.

In spite of these emerging problems left to national politicians to find a suitable solution, market globalization continues. Similarly, as the issuing and pumping of the well-structured money in financial and capital markets, in full compliance with the proverb "all roads lead to Rome" back, these foreign direct investments and loans of the World Bank and MMF, in addition to the made profits led to the inflow of achieved profits of the domestic (corrupted) mighty and rich men in the western safe financial harbors. This way of the money lending, trade, and investment on these created and further supported international markets was so lucrative that writing off (wiping out) of the accumulated debts of the underdeveloped countries was a usual practice because these countries addicted to loans (borrowing) will continuously contribute to an even greater return on this type of long-term investment. And this practice continues to the present day. The period of this first phase of neoliberalism is known as neo-colonialism. It is worth mentioning that making the Cold War was very expensive for all major involved participants. Triggered with this as well as with the afore lucrative financial fruits achieved at very low costs in the UK, as an example, led to the privatization of state companies and limitation of the power of trade unions. This interplay of neoliberalism in the USA and UK in interaction with the social welfare policy in the rest of the NATO security zone caused the Fall of the Berlin Wall and then of the Iron Curtain too.

globalism as an interplay of neoliberalism, social market economy, and globalization

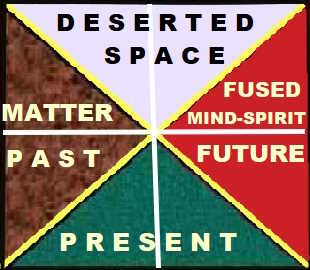

Bipolar DIA Binary Way of Thinking

(Recti)linear Creative Framework for the Orientation in Time AND Space

Ultimate Upshot of the Rectilinear and Traditional Dialectic Way of Thinking within the Rectilinear Space and Time: "PRESENT TIME", as An Ultimate Upshot of the Binary "OR - OR" Choice between the TWO Bipolar Dialects - Abandoned Hollow and Present Time

These events coincided with the information technology and communication revolution, which additionally facilitated the transformation and fusion of the international markets into a global market (Global Village), especially this contributed to the emergence of global financial markets. These forces of globalization added extra fuel to the rise of popularity of neoliberalism, which triggered further deregulation of labor markets and financial markets, the marketization of national social institutions and agencies, and the regulation of global trade in goods and services between national states by the establishment of the World Trade Organization (1995). This marketization of social institutions and agencies is characterized by trade and sales of the misfortune of the wretched unemployed [financially dependent clients and helpless patients for additional milking tax-payers' money] to private providers of services of various courses using the brokerage services of precisely these social institutions and other government agencies [ social market economy ].

Although this is presented as helping these unfortunates to get a job faster, in this artificially created social ambience of a societal reality beyond the scope of normal human understanding, it is in fact a purposefully intended and deliberated interplay of various parasites and social, economic, and political intrigantes for their own gain within this created social labor market. These negative trends in interaction with no more need for the social welfare institutions because this form of the regulation of social ambience and market fulfilled its role in the fall of traditional communism, gave rise to accelerated privatization of public services such as healthcare, social housing, education and the like. Actually, only the bureaucratic (and social security) structure of the social welfare state survived and was transformed into some kind of social police and worker's police to cope with this new situation in the resulting societal ambience of this natiocratic interaction between the social market and the labor market ( social market economy ), whose budgetary implications are absorbed with the continuously growing role of the flexible labor market.

On the one hand, privatization of state companies in the economically and financially conquered ex-communistic countries resulted that the destiny of their workers was simply handed over to foreign corporations of this invisible global state. In most cases, this kind of (foreign) investment ended with the sale of property acquired with previous generations [most retirees were brought to the begging stick] and the closure of these enterprises acquired in this corporate manner, which was imitated by the newly forming domestic (corporate) elite: the turbo-richmen,

- without having previously prepared, empowered and trained their workers and other future "owners" nor learned them how this way of organizing business works, as well as starting this way of privatization without sufficiently developed financial markets and other mechanisms for its smooth functioning [including laymen-brokers and organizers of this stock exchange] in cooperation with domestic legislative and executive privatizers.

- All this reminds me of the foreign imposition of this natiocratic democracy, even in countries where the majority of the population can neither read nor write except to guess, and then to round out ballot, and in this manner to participate in the struggle for the distribution of awards of this kind of natiocratic democratic lotteries.

- And what to say about the achieved level of development of citizens' awareness and conscience in the role of voters as a precondition for a democratic way of political organization to function in a humane way worthy of a human being, respectively whether this necessary condition is met and fulfilled in the most developed countries, which practice this modern naciocratic manifestation of democracy?

that is, the abolition of jobs [competition decrease to their goods and services too] and transfer of the fate of these ex-workers back into the hands of their national state [social market economy presented above]. Just pay attention to this kind of interplay between the faceless free (global) market and the national state, respectively between neoliberalism and this established social market economy. This interplay of neoliberalism, the social market economy, and globalization is known as globalism. On the other hand, in countries of the source of these foreign direct investments (FDI), the aforementioned led to the outflow of capital as well as to the decrease of the available working places there too, as a result of this relocation of production capacities and services. In short, although ITC revolution created lots of new better-paid jobs, the transition and transformation of the obsolete qualifications required even larger investments, which were unavailable as a result of this outflow of capital worldwide.

Either way, as end result of this privatization and global foreign direct investments, instead of contributions to the public budget of countries of the origin of FDI, as well as to the public budget of the recipient countries of these foreign direct investments, corporate shareholders and private companies have been richly rewarded. Furthermore, their taxes have been cut globally, regulation reduced, and other stimulative incentives are granted including also subventions to assist their business, that is, not to close the factory or not to lay off workers (extortion of taxpayers' money) while these formed holes in the public budget were filling with the increased taxation of citizens as well as by increasing internal (and external) debt. In short, at the beginning of the 21st century, it seemed, nothing can stop the ascent of this global neoliberalism.

the decline of neoliberalism

And then came the economic and financial collapse in 2008. Although I tackled some very important issues of the facelessness of market in my doctoral dissertation proposal (1999), such as: the shareholder way of organizing corporations, the postulates on which financial markets function, as well as by introducing the concept of debt economy dia economy of debtors ( debtism ) at the beginning of 21st century, there are still many open questions. For example, why the hidden masters of this global state made decision to empty the accumulated cream in the global financial markets? In my opinion, they could handle the issues and challenges of this financial crisis for at least the next 20 years [jubilee of the Great Depression] by pouring this financial fog from the hollow into the created void of this global market. An explanation might be their estimation that they have been already very well networked and structured (to fail), so the state will be compelled to compensate for their losses and later to further reward them as well, or there were some insurmountable disagreements within their invisible global state.

Anyway, they for sure overestimated the power of their virtual global state compared to the power of real national states, especially by impoverishing the broad masses in their own countries which further strengthened national right-wing and left-wing movements, that is, they forgot that even they cannot so simply cross over these firmly established boundaries of natiocratism [by creating a kind of globalcratism]. In short, these impoverished masses cannot follow these uncertain paths of free movement of capital, goods, and services at the global level due to established national state barriers. Moreover, even if it were possible to overcome these state barriers, there are no economic incentives for the movement of the lower and working segments of society, because global capital goes where the costs of labor and raw materials are lower. In any case, without this absorbing role and support from the social market economy, the process of globalization could not take place so smoothly (globalism).

Along with this process of globalization, the awareness and knowledge among these lower strata of society has also grown in the sense that their survival, as well as the survival of their families, depends on the well-being and survival of their nation-states. In other words, their global activities like a boomerang changed the national democratic ambience and mood of these voters, and politicians as well, who always bend to the side where the wind blows. To stay in power, they simply adjusted their political programs to this new national democratic (right-wing versus left-wing) reality to absorb, make blunt, control, channel, redirect, and guide political intentions of these unpredictable masses in their desired direction. To this should be added that almost all worth privatizing globally have already been privatized in the way explained above, which also contributed to a shift in the inclination of the hidden masters of this established economic and financial order towards globalization.

Either way, their seemingly reasonable explanation put forward to blame for the economic collapse in the 2008s the deregulation of financial markets and the lack of scrutiny of financial institutions is not entirely satisfactory because none can regulate and control the still divided global markets by different national interests. In addition to this, there is still a lot of unknown in the way, how the efficiency of financial markets works at the global level. For this reason, a better approach is to still see this global village as an intertwined and tangled ball without a visible clue in it. In any case, no one can better understand these global trends than the ubiquitous noses, eyes, and ears of this invisible global state which continues to influence these real developments in the global market by working and acting in the background of these global events. Regardless of all this, as a result of this economic and financial collapse in the 2008s, against these forces of global integration and globalism in general, the role of the nation was re-examined and reaffirmed allegiance to the national state, and the forgotten protectionism when deemed in the protection of higher national interests was called for help. It is worth emphasizing here that the various protectionist trade barriers for free access to national markets were present and implemented during the entire period of neoliberalism.

The age of debtism

Concluding this era of the rule of neoliberalism and its last stage of development known as globalism, this grand social, economic, and financial experiment for testing the claim that free markets really do work best of all known mechanisms and regulators of economic and financial flows as well as able to regulate themselves (at the global level too), experienced the similar fate as its predecessor (classical laissez-fair liberalism), that is, failed as a consequence of another Big economic and financial crunch in the year 2008. Moreover, this type of liberalism was replaced again with the increased state intervention and regulation of the financial sector and market, this time at the global level. In short, using tax-payers' money, the banks' debts were taken over and recapitalized without the right of ownership (B shares), and thus renounced its future participation in profit sharing. The remaining part of the debts was transferred to special containers for storing this type of 'radioactive waste', while cheap loans and guarantees given by the state to these well-networked, positioned, and structured companies and banking institutions enabled the transfer of market risk to the (national) state.

In this way, the state is reduced to a cheap hand to assist and subservient to these oversized national and global players, who were too well structured into this purposefully created national and global network by them to fail, that is, to be punished in line with the basic principle of this 'faceless free' market of neoliberalism. As a result of this, it seems, this visible auxiliary hand of the state is more useful in this unfavorable social, economic, and financial scenario in time and the appropriate situation in space than the invisible hand of the impersonal free market. In other words, the invisible hand of the faceless free market is more desirable when the business is going well or flourishing while this visible auxiliary hand of the state is preferred and welcome in difficult times for the hidden masters of this global state, that is when the time came to pay the full price for their business market risk. Or it is again a matter of the magical interplay of the faceless free market and accumulated darkness of debts in national states and financial bubbles in the global financial market when this hidden darkness is illuminated for a short period of time during the transformation of this invisible hand of the impersonal market into the visible auxiliary hand of the state by this wizard. In other words, with his magic wand, the masks were removed from certain participants of this global business game, forcing them in this way to leave this faceless free market, that is, to stand under the public spotlights of these all-saying theatrical stages and appropriate theatrical acts in this artistic performance of an economy run globally with the help of continuous increase of debts at all levels of social organization and misuse of money of both taxpayers and countless savers (debtism).

Implications of this latest state regulation and intervention at the global level are numerous. For example, interventions of the reformed and reconstructed government agencies and services (social police), adapted to the principles of this newly established social market economy, penetrated deeply into all spheres of private and family life. To this should be added the widespread practice of social exclusion of undesirable groups and intruders, especially those who do not agree with them or have a different opinion and view of this established economic and social order, as well as the displacement of state institutions and social services at the mercy of raw social "free" markets coupled with further labor market flexibility, and austerity at the expense of the impoverished lower natiocratic castes, as well as attempts to further reduce government spending on social programs compared to the previously widely accepted social rights to a piece of bread for everyone. And all this without reducing the number of employees and bureaucrats in the social sector. The result of this latest adaptation of the social-market economy to the demands of debtism is the additional discrimination of vulnerable groups of people for purpose of their segregation and social apartheid, in order to be formed additional natiocratic castes (natiocratic outcast:: social waste) according to race, nationality, citizenship , ethnicity, religion, gender, age, as well as other forms of social differentiation and segregation from the privileged natiocratic castes, especially on the 'flexibil' labor market.

debtism as an interplay of a faceless free market and state regulation and intervention in cooperation with irresponsible social market behavior

Despite the marginalization of neoliberal ideas, on the TV, newspapers as well as during the large left and right-wing gatherings and demonstrations, the word still goes about neoliberalism, or about the resurrection of neoliberalism, although opposite processes were initiated: regulation of capital and financial markets, public ownership of banks, increasing trade barriers and protectionism, as well as the increased influence of state and network structures in the global economy in general. In other words, although many view neoliberalism as the main culprit for this failure of neoliberal market self-regulation, they actually failed to notice this previously explained interplay of the basic ideas of the faceless free market and state regulation and intervention [ in interaction with this crippled social market economy ]. Or put it in another way, if it really was the case, in full compliance with neoliberal ideas of the self-regulation of the free market, this would result in the collapse of many of the international banks because laws of the free market ruled and made such a judgment. For sure, if there was no feasibility of intervention of the state, that is, if the interplay of these twins would not be feasible in cooperation with other ways of irresponsible social market behavior: offspring, mechanisms, and regulators of the natiocratism.

In other words, all unpaid debts and other obligations caused by them will be paid by taxpayers, both directly and indirectly through various types of social benefits and other expenses for removing and solving the consequences thereof. For this reason, the misuse of the social market economy significantly contributed to the emergence of debtism, and it will continue to play a bigger and bigger role in the following stages of the development of debtism, that is, of the debt (decadent) "capitalism", because there will always be less and less money left for everything else anyway. This is not only about direct (visible) social expenditures, but primarily about various disguised and hidden forms of manifestation of parasitism, which includes the richest strata of the natiocratic society, as well as all those who adapt in this unethical way to this social market way of doing business. In this context, any type of tax avoidance, that is, any purposeful reduction of this general social obligation, and not only the more visible ways of sucking, appropriating, and redirecting (in terms of social redistribution of) taxpayers' money, is a hidden form of manifestation of social market parasitism.

For this reason, it could be said that unpaid taxes to the established social community for non-payment of dividends to shareholders (which could potentially be used to increase real consumption, as well as start new investments, in the purpose of increasing business diversification and market competition), is also a hidden manifestation of irresponsible social market behavior. Reconsidered from this broader societal (business) perspective, turning and focusing attention on direct (visible to all) social issues of the most vulnerable layers of society (collateral victims of economic crises and recessions) is a form of not benevolent and cheap "throwing dust in the eyes" in order not to be seen, or to mask the deeper, broader, and more far-reaching incentives, motives, and goals of this way of doing business supported by the application of various measures of the social market mechanism.

In short, this form of cheap buying of social peace, obedience, and control of citizens, as the utmost result of their (excessive) borrowing and over-indebtedness in the long term, is in fact a form of buying and selling their future, as well as the future of the coming generations (to the detriment of their future as well), that is, this is another additional type of manifestation, calculation, and payment of the compound interest rate ("interest earned on interest"). For example, in democratic societies, all of the aforementioned in conjunction with one another narrows, (significantly) limits, and minimizes the proclaimed freedom of speech, freedom of creative action, as well as enjoyment of other benefits of life. In other words, in this way (of manifesting hidden forced overtime work), the free time available (for raising and spending time with children and relatives) is significantly shortened, as well as their intellectual and reasonable abilities are reduced [in the sense that "if the work really created man, a donkey would have already evolved into a man"], and thus their political rights (based on common sense reasoning) are being redirected and limited.

The Natiocratic Pyramid

Summing up everything previously said, the (extremely) socially vulnerable and over-indebted citizen has nothing (much) to say in a natiocratic democracy (of debtism), but only to be silent and work by paying taxes and other impositions to the rulers of this established social, financial, economic and cultural value system. Keep in mind that even in a natiocratic democracy it is important to have a (feasible) chance to be elected (to government and management bodies), not just a (formal) right to elect others (for the rest of your life), as well as that due to this hereditary inferior social status, similar prospects are likely for their offspring too. It is easy to conclude from this that this type of (hereditary) manifestation of political inferiority will also affect their future prospects in the economic, financial, social, cultural, business, and private spheres. Or expressed in another way, this, in addition to natiocratically ideological suitability and related national aspects and features, determines their probable economic, financial, and socially cultural status in society, as well as the possibilities of their advancement in this form of manifestation of the natiocratic social pyramid (of encompassed, embedded, and captured time and space).

increasing competition on the market through the introduction of different forms of ownership

Theoretically too, as an alternative, instead of taking over their debts and market risk using tax-payers' money, as well as further borrowing and other ways to increase debts, or selling license rights, governments of the most economically developed and militarily powerful countries could invest these financial resources to create publicly owned companies. Keep in mind that this was an unprecedented monetary state interventionism and interference in the decisions of the free market mechanism. But practically due to shortcomings of the natiocratic democracy (limited political mandate, for example), there is no guarantee that the government of the opposition parties will not later privatize these public companies.

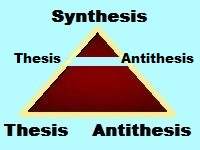

- [strengthening and supporting their financial and political position in this way (THESIS).

- For this reason, in full compliance with this form of the political natiocracy, during the process of the privatization of public companies and services, the appropriate option is a continuation of the privatization of public asset as much as feasible and workable to undermine the economic, financial, and political position of political party opponents (ANTITHESIS)

- until nothing is remained to privatize (SYNTHESIS), which will unite with this final act all political parties ideologically at the national level (THE RENEWED THESIS) to search for new such business opportunities of privatization globally (THE RENEWED ANTITHESIS), and so on in time and space until everything is privatized at this global level (TEMPORARY CONCLUSION).

- In the case, new business opportunities of privatization are emerged somewhere in the solar system or in the accessible universe (THE RENEWED DIALECTICAL ANTITHESIS), then the currently achieved temporary conclusion is no more valid [transformed in THE RENEWED DIALECTICAL THESIS] because this already ex-temporary conclusion is challenged by this new business opportunity of the privatization of public companies and services (DIALECTICAL SYNTHESIS). And as a result of this, a new cycle of this main dialectic method has already started from the beginning.

- I hope you now know what the next step is in this well-known natiocratic societal universe as well as by using this main dialectic method to present the opposite way of natiocratic thinking regarding this bipolar transition and transformation of this black-white scenario in time and the appropriate situation in space until its final binary outcome is achieved: black or white.]

As a result of this, in the political systems of natiocratic democracy, short-term social, political, ecological, economic, and financial incentives will always prevail, which is in fact one of the reasons for the alternating coronation of these twins of natiocracy (faceless market and state) for a limited period of time: until the next great economic and financial crisis. In other words, this kind of transfer of the political power and economic and financial decision making to the will of the faceless free market as a mask will at the end only cause the state regulation and intervention to save losers of this 'impersonal' market and vice versa because even this long-term periodic interaction and cooperation of the state and free-market contributes to the continuation of the functioning of natiocratic democracy: quite a certain change or adjustement of the political direction as a result of strengthening the right and left political wings (political power redistribution).

In full agreement with the previous thoroughly elaborated natiocratic white versus the black view of the world around them [private or public, in this particular case] thoroughly elaborated above, to make up for this shortcoming of the natiocratic democracy, they are ideologically against organizing companies in some other way, the result of which is the prevention of competition of different property forms at a global level. More about this will be said later. In any case, the question arises, how can a party manage and lead the state, without having in its ranks or within the established state union the personnel who would successfully lead a state enterprise. In fact, this is about equating state or public property with party ownership, which is only the first step or a hidden natiocratic channel that leads to their transformation or use for private purposes, and then for personal purposes (where the natiocratic concept "private" is a group and transitional interpretation of the notion "personal"). But this issue intrudes and further complicates the typical natiocratic duplicity (hypocrisy) of these duplicitous persons (persons with two faces: a public and a private one). In short, in every natiocratic society, public goods and property, including taxpayers' money, are used more or less to implement the (private and personal) interests of the ruling natiocratic elite. Despite some similarities, the scales and methods used for these purposes differ. Also, keep in mind, all natiocratic economic and social orders are actually against the idea of competition, and for this reason, this economic way of making war was only used as a last resort because this kind of making war is also very expensive.

No doubt, this ideological confrontation of the property forms leads to a conflict and confrontation of these different interests at all levels, a scenario in time and the appropriate situation in this global space that has already taken place during the Cold War period. Pay again attention to this repetition of what has already been seen: a return to the past spending my, thy, our future. Either way, the debtism has reversed or undermined nearly every aspect of classical capitalism, from the change of the trigger and ruler of this economy [capital ⇢ profit ⇢ cash ⇢ debt], progressive taxation at the expense of citizens, the gap widening in the treatment of companies and citizens, welfare distribution, and non-market incentives by rewarding its losers, to the segregation of unemployed and workers in natiocratic castes, and as a consequence of this, to the social and economic segregation (and discrimination) of their children too. In short, the mixed economy of public and private companies was dismantled by natiocratic elites with huge help of the state structures, who adjusted and revised rules of a potentially efficient and transparent market economy (free market with recognizable faces) for their own benefit, that is, in favor of a global financial elite, enacting and legally adopting self-serving economic, financial, and social policies (and selecting the appropriate politicians) which is in full compliance with natiocratic democracy, what actually allowed them to get rich.

As a conclusion, instead of conducting a typical natiocratic black-and-white discussion about the role of the free market versus state regulation or interventionism during the solution of the problems that have arisen, including the way of organizing the economy and conducting business, it is far more important how and for what purposes (unproductive, productive, entrepreneurial) these mechanisms are applied rather than spending time in a fruitless ideological debate about which of them is more efficient and effective. In my opinion, the application of these mechanisms (in mutual cooperation) in terms of encouraging entrepreneurial (in the first place), infrastructural, and productive business activities in all areas of the societal organization (bringing up, education, art, culture, pensions...), while non-productive activities (investments in the social sphere) are a necessity.

Although many will disagree with me, it also includes disproportionately excessive investments in healthcare without first taking appropriate preventive measures to prevent this kind of necessary "evil" by investing in improving working and housing conditions, as well as living conditions in general: market purchasing and material availability of healthy ways of nutrition, entertainment and recreation, promotion of Good at the expense of reduction of committed evil, etc. Keep in mind that these are two dialectically contradictory processes that cancel out each other's effects, both in a positive and negative sense. Furthermore, if the typical natiocratic role of connections and ties in getting a job is not prevented or significantly reduced, then excessive investment in education and the arts is also pointless. It follows from this that only investments in infrastructure and entrepreneurship are desirable or necessary, because at the end of the day one has to earn a crust of bread somewhere, as well as to be provided an adequate way to arrive in the workplace, regardless of all the injustices, irregularities or shortcomings of the natiocratic way of organizing society.

start-ups - entrepreneurship based on the humane, creatively individual way of thinking

Seen from the perspective of a human, creatively individual mindset, the afore-explained and elaborated way of thinking in terms of white versus black related to the natiocratic way of organizing society, understood also in terms of the competition of different property forms, is much more complex. In short, even if these ideological disagreements were solved, that is, the mixed economy was reintroduced and tolerated, there are lots of other unsolved issues for a successful running this economy. Firstly, the issue of the privatization of these companies has to be solved in a constitutional way [putting this in the constitution preamble], supported by an independent public board for entrepreneurship [not by political parties for reasons previously discussed]

- [the most capable and competent experts in the whole country as well as the best individuals capable to distinguish Good from less good choices, and to smell and feel the success of the chosen entrepreneurship too: profit]

similar to a central bank to also oversee privatization issues of a public start-up company, as well as to regulate the height of the minimal percentage of shareholder votes to be accepted the referendum decision on its privatization [the best practices reconsidered and updated on a yearly basis], for some justified reasons or due to the agreed interests of its shareholders. The final percentage of shareholders in order to approve privatization has to be regulated by the start-up company statute.

As the role of creative abilities is highly valued in any entrepreneurship, especially in this one, the business ideas have to be adequately paid by the shares issued. In short, these key-actors are rewarded by the most shares, and these extra rewarding shares unlike other stocks are only valid while making a profit otherwise they are annulled. In other words, each knowledge creator should continue to create new cost-effective business ideas, or someone else should be recruited who can lay a new golden egg because for the long-term survival of such an established company the continual creation of new knowledge is crucial. To be further discouraged public listing this business venture on financial markets, the issued shares must be of an internal nature, that is, valid internally and until the employee leaves the company, for one or another reason. After every few years of working for the company, the new shares are issued at the end of the year, but only if the profit was made in this period as well as not too many new shares issued because the future is more important than the past (living from the old glory) to attract easier new talents with the appropriate skills and qualifications. Because creative persons are a rarity [the most precious jewels of the entrepreneurship] and for this reason, they are the best rewarded until lay golden eggs, they are very rarely good managers [that's why lots of initially very successful start-up companies failed after a few years of business success]. Apart from this, why would they waste their so rare talent and appropriate creativity (gift of God) doing (boring for them) managerial jobs?

In other words, the next step is the selection of top management. Instead of board directors, a local or regional independent public board for entrepreneurship is founded as a place to learn these skills, in addition to providing adequate professional and advisory services, that is, whose members later to be promoted to the central public body because some of its members will sooner or later try something else [a new business, social or political profession]. The start-up companies have to outsource accounting, finance, statistics and analytics departments and the like to their local or regional independent public body for entrepreneurship, which will organize these services under a local or regional umbrella, to be prevented fabrication of appropriate reports (false or fake reports), to reduce business management costs as well as to enable the top management to concentrate on key business management issues. However, start-up companies will have on-line access to these reports on an ongoing basis as well as receive helpful advice from this local or regional public body for entrepreneurship. In the final step, after the business plan was made and approved, key-personal in the production or service department is recruited, as well as other employees of this start-up company. Each of them also should be chosen individually by the teamwork of the business idea creators and top management including the advisory role of the local or regional independent public body for entrepreneurship as well.

This way of establishing a start-up company is very similar to establishing a virtual company, which is gathered around a temporary project. For this reason, the virtual way of organizing a company can be used for testing the aforementioned business ideas to reduce the market risk of failure of starting a company. Or put it in another way, only after several successfully completed projects on a temporary basis (virtual company), a start-up company should be approved and set up. Since central, regional, and local public body for entrepreneurship has a Great Picture and insight into the creative and management abilities of all available talents with special skills (central database), they can centrally, regionally and locally regroup gathering the best of them in teams for creating these start-up companies. The organizational structure should be very flat to cut the costs of floor-management. In other words, all employees should mindually and spiritually be self-empowered to be able to self-control themselves and to become SELF-RESPONSIBLE for assigned tasks in order to be decreased in that way a need for direct supervision of them. To cut this story short, a CONTINUAL increasing level of the achieved development of consciousness of the employees of a start-up company, manifested by the recognizable human bites of the CONSCIENCE for not doing a good job, is of essential importance in this way of organizing business. Only in this way the desirable two-way up-down self-promotion, based on its demonstrated abilities during the execution of assigned tasks, enables successful teamwork as well as start-up company success as a whole. The best and always the best for a particular task should be promoted to be leaders of the week, month... year during business project implementation.

In this mode of setting up start-up companies, the national, regional, local government, or a trust fund provides the necessary funding, which is gradually redistributed in shares to its employees, of which the largest number of shares belong to the creators of business ideas. In case of a successful business start-up, dividends realized on the basis of public shares will go to the fund for starting new business ventures under the supervision of the aforementioned public boards for entrepreneurship. Keep in mind, a too high public stake in equity of the start-up company will reduce incentives to retain existing key-employees as well as to attract new talents. Due to the relatively low level of achieved development of consciousness and conscience in general, this way of organizing start-up companies and new business ventures is suitable for setting up small companies [and later for their gradual transition and transformation in the medium-size companies].